and quarter on quarter the economy contracted by 0.5% over the first quarter of 2008(Eurostat data):

This will be very brief coverage of these results at this point, since this is, at the present time, all the detail we have. A more precise and extended breakdown of second quarter GDP data will be published by the statistics office on September 8.

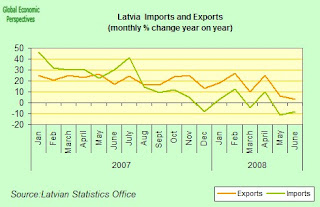

Exports Waning

Latvia's June exports dropped 3.6% over May, and were up 3.1% on June 2007. The rate of y-o-y increase in exports is thus dropping rapidly. In June compared to May the most rapid decrease was in exports of vodka (by 55.8%), of rough-cut wood (by 23.6%), of iron and non-alloy steel (by 22.0%), of chocolate and other food preparations containing cocoa (by 17.4%) and of clothing, not knitted or crocheted (by 11.3%), but exports of paper and paperboard, articles of paper increased by 44.1%, pharmaceutical products were up by 31.2%, and machinery and mechanical appliances by 14.6%.

Compared to June 2007 the largest exports increase was in wheat and meslin (exports to Lithuania, Oman, Denmark and Poland) which were up by a multiple of almost 13 times (increase from 187 thsd lats to 2414 thsd lats), in fish, fresh, chilled or frozen (by 85.7%), iron and non-alloy steel (by 43.5%), articles of iron or steel (by33.8%), pharmaceutical products – (12.1%). Exports of sawn wood decreased by 52.3%, furniture, including mattress and articles of bedding and similar furnishing was down by 33.0%, chocolate and other food preparations containing cocoa were down by 24.3%, and veneer sheets and plywood by 17.8%.

In June compared to May the most rapid increase was in imports of electricity – by 54.7%, of iron and non-alloy steel (by 48.4%), meat of swine, fresh, chilled or frozen (by 36.6%), of cigarettes (by 30.7%), but imports of agglomerated cork decreased by 35.9%, as did particle boards (by 28.0%), pharmaceutical products (by 17.2%), plastics (by 13.5%), electrical appliances and equipment (by 5.6%), and coniferous sawn-wood (by 4.4%).

Compared to June 2007 the most notable decrease was in imports of sawn wood (by 76.0%), passenger cars (by 49.7%), furniture, including mattress and articles of bedding and similar furnishing (by 37.9%), machinery and mechanical appliances (by 29.8%), clothing, not knitted or crocheted (by 19.8%). Imports of pork and pork products increased by 73.1%, iron and non-alloy steel (by 42.8%), residual fuel oils (by 36.8%), diesel oil (by 27.2%) and electricity (by 13.9%).

As a result Latvia's trade deficit increased again in June when compared with May.

Year on Year Inflation Eases Back Slightly

Compared to the July 2007, Latvian consumer prices increased by 16.7% in July, of which prices for goods increased by 16.4%, while prices of services were up by 17.4%, thus inflation is now down slighly from the May peak of 17.9%.

Compared to June 2008 the average consumer price level in July 2008 rose by 0.3%. The average price level for goods did not change, but prices of services increased by 1.1%.

Within the food group the price increase of meat and meat products by 3.1% had the major impact on consumer price level. Cereals, especially rice, non-alcoholic beverages, sweets, fruit, pastry-cook products, fresh fish and potatoes all became more expensive as well.

The price of transport services increased by 6.6%, of which the prices of tickets in intercity buses increased by 28.0%, while prices of tickets in passenger rail transport was up by 17.4%. The average prices of automotive fuel rose by 1.6%.

With the extension of the traditional seasonal sales period the prices of clothing decreased by 6.4%, but the price of footwear was down by 8.2%. Due to the sales the sports, camping and open-air recreation equipment, household textiles, glassware and tableware and bicycles all became less expensive. The prices of computers, TV, audio, video and photographic equipment, telephones, goods and services for the maintenance and repair of dwelling, flowers and toys decreased as well.

Labour Market And Wages Not Adjusting To Downturn

Neil Shearing of Capital Economics makes the following pretty valid points in a research note released soon after the Estonian GDP data were made available. According to Shearing there are three good reasons to think that things will get worse before they get better:

"Firstly, labour markets have yet to react to the slowdown in the first half of 2008. The unemployment rate has actually fallen in Latvia and Lithuania and has remained flat in Estonia. But surveys point to a rise in unemployment over the coming months,"

"Secondly, the growth outlook for the euro-zone has deteriorated in recent months. Since exports to the euro-zone account for roughly 15% of GDP in the Baltics, this could hit manufacturers in the region hard... it is becoming even more difficult for the region to rebalance towards net exports,"

"Finally, external financing conditions are likely to become more difficult over the coming year, as global liquidity dries up. This will make it much harder for the region to fund its huge current account deficits. As a result, these deficits will have to shrink, and this requires a further contraction in domestic demand," he concludes. "The upshot is that we expect the region to enter a deep and protracted recession."

As we can see Latvia's unemployment has risen very slightly in recent months, but it is still well below what it was only as recently as a year ago.There were 55,436 unemployed in Latvia in June, and the unemployment rate was 5.1%, only the same as it was in September 2007.

I would add at least one more issue to Shearing's list, the protracted inflation issue, and the difficulty of the elderly Latvian labour market in adjusting. What we are seeing in Estonia is more people retiring from labour market activity than are joining the market, and hence unemplyment has been falling. I don't imagine things will be that different in Lativa, and thus although unemployment will rise, it will not rise as much as some are expecting (many are saying that the labour market is a "lagged indicator" and this is true, but there is more than that at work here).

So given the labour market can't adequately correct, then wages and prices won't moderate as much as they should, which, given that domestic demand is now more or less done as a structural driver of Baltic growth, is going to make the issue of getting exports competitive very hard work indeed.

Bottom line: Latvian GDP will soon be going under water and into negative territory, my feeling is it will now be quite some time before we see it "resurfacing" again.

No comments:

Post a Comment